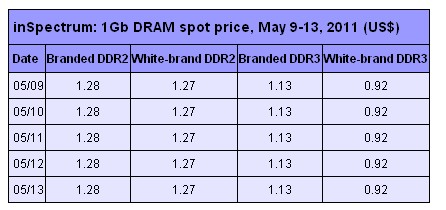

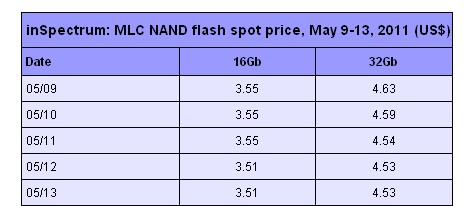

Nothing much has changed in the DRAM and NAND flash spot markets in May, with average selling price (ASP) for all mainstream items continuing posting an average weekly drop of 1-2%. Demand is sluggish across the board amid bearish sales outlook for both PCs and consumer electronics, especially for tablet PCs.

In the DRAM spot market, some down-graded items have been released to channels at competitive pricing. But such cheap parts have failed to stimulated any meaningful demand as most brokers/traders and memory module houses remain much concerned about poor sales in the second quarter, deterring them from making procurement.

While leading memory module houses have seen poor sales in recent months, most of them have tried to maintain stable prices, fearing that any move to cut prices could trigger a price free-fall in the market. Most had their quotes for the benchmark 2GB DDR3 modules priced at about US$18.60 this week (May 9-13).

The NAND flash spot market also has also seen similar sentiment. Industry players have growing concerns about tablet PCs' outlook, and are waiting for cheaper parts to be released from Micron Technology prior to its release of results sometime around the end of May. Thus, most have chosen to put their procurement on hold amid an unclear market outlook.

According to local memory brokers/traders, some competitively priced multi-level cell (MLC) NAND flash parts are available from Hynix Semiconductor. But sales of the cheap parts have been slow. Some of the brokers/traders said that they do not prefer such parts, as extra efforts may have to be made tuning controller settings in order to allow the chips to perform properly.

|