DRAM prices trended down last week (June 13-17) in both contract and channel markets amid blurred demand visibility and sluggish sales. But vendors are believed to be launching even sharper price cuts trying to stimulate sales and lessen inventory pressure.

Contract price for the benchmark 2GB DDR3 module went down by about 5% to US$18, translating to US$1 per Gigabit, in the first half of June, marking the first slip since January. The downhill price trend reflected an industry-wide concern for inventory levels at OEMs and low order visibility into the second half of the year.

Citing buyers at key PC OEMs,believes most of them will continue cutting their procurement through August in order to lessen inventory pressure. Most major OEMs' current DRAM inventories are higher than the industry average of six weeks. If sales show no meaningful rebound in the near term, most prefer to halve their inventory in coming months.

As most vendors now choose to negotiate price only once a month rather than twice as seen in previous months, believes a sharper downside pressure is forthcoming in July. Contract price of a 2GB DDR3 module will hit about US$16.5 in July, translating into a more than 5% sequential fall, it projected.

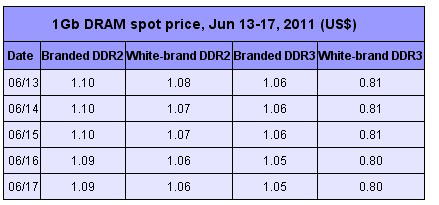

For the channel market, trade volume remained low. Industry-wide fretting about acute inventory pressure among all major memory module houses sent spot prices to even lower levels. expects a sharper price cut will be launched by module houses, meaning a spot price tumble is likely.

|