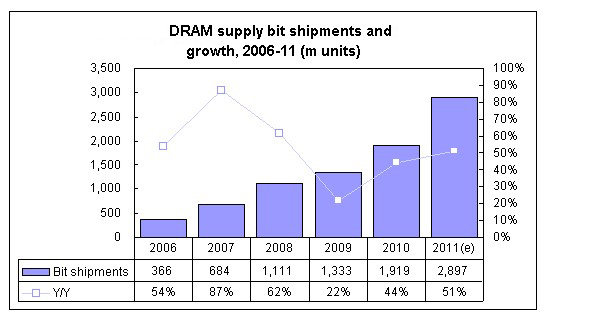

Global supply of DRAM is forecast to reach 2.9 billion 1Gb-equivalent chips in 2011, up 51% from 1.92 billion units in 2010. The anticipated higher supply bit growth, compared to 44% in 2010 and 22% in 2009, will be driven by major producers' output ramps through process upgrades.

Consequently, the present DRAM memory glut is likely to persist through the end of 2011 which will continue to have a negative impact on chip pricing.

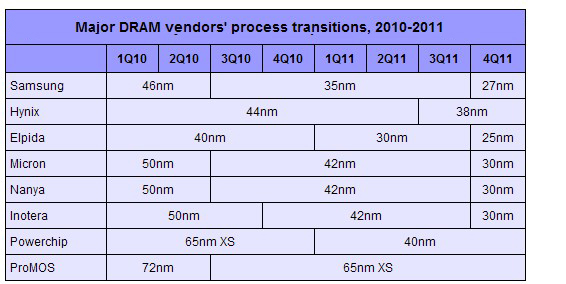

Samsung has been accelerating the migration to 35nm DRAM process technology. The industry leader will see 60% of its DRAM products built using the node in the fourth quarter of 2011, and is set to move a newer 27nm process to volume production around the same timeframe.

Samsung will likely see its bit shipments climb 60% in 2011, compared to growth of 68% in 2010.

Elpida Memory migrated directly to a 40nm node from 65nm in 2010, and has successfully completed development of 30nm with the node technology kicking off volume production earlier in 2011. Elpida's production subsidiary in Taiwan, Rexchip Electronics, is gearing up to convert all of its wafer starts to the more advanced process in the fourth quarter of 2011.

With Rexchip scaling up its output on 40nm, Elpida is expected to achieve 67% bit shipment growth in 2011. In 2011, the Japan-based vendor only managed to see 36% growth.

Hynix Semiconductor carried out its transition to 44nm process technology in early 2011, and is moving forward to shift to 38nm. The vendor will see 72% of its overall DRAM output made using 44nm in the last quarter of the year, while the more-advanced 38nm will contribute 8% to the total output.

Buoyed by output growth using more advanced technologies, Hynix may see its bit shipments rise 45% in 2011.

Micron Technology may manage growth of only 39% in Gb shipments in 2011, lagging behind the other three major DRAM chip suppliers.

|