Having gone through the 2007-2009 downturn, the DRAM industry was just about to celebrate upcoming profitable years. But the rebound lasted only one year, and the industry has slid back into another recession along with the global economy.

According to a recent IC Insights report, the DRAM market is forecast to decline 13% in 2011 following a strong recovery in 2010, when the sector enjoyed a 75% jump.

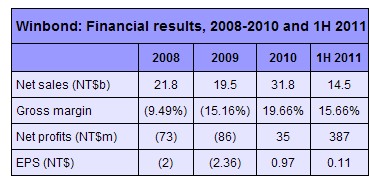

Winbond Electronics in early 2010 made it clear that the company would move to transform into a niche DRAM and NOR flash maker with an aim to withdraw from the mainstream PC DRAM market, while fellow companies still pinned their hopes on a recovery. Winbond succeeded in phasing out its PC DRAM business starting 2011 and later in the year, sluggish PC sales and weak market conditions have emerged to cast a shadow on the commodity memory sector's outlook.

Winbond has diversified its product mix to include specialty DRAM, mobile RAM and NOR flash, and begun in-house development of production technologies in a move to reduce its technological reliance upon overseas makers, according to company president Tung-Yi Chan. The following is an interview during which Chan discussed Winbond's diversification strategies, new business opportunities and his outlook for the company.

Q: Some believe that the rise of mobile, Internet-connected devices will impact the current DRAM marketspace, for example, losses in PC consumption of DRAM. How do you see the significance?

A: Tablet PCs are undeniably cannibalizing the market for conventional computers. As a new market, tablets have brought opportunities and also challenges to component suppliers which have been concerned with development of standard desktop PCs and notebooks. The point is how to tap the opportunity rather than feeling trapped by the present difficulties.

For example, a TV will not only use SDRAM but also NOR flash, with demand for the latter actually seeing more brisk growth. Winbond has identified this trend as a business opportunity, and realized that breaking into the supply chain of brand-name TV vendors is a must.

Q: Can you talk about Winbond's customer relationships after its transformation?

A: After switching our focus from the PC segment to consumer electronics, Winbond has built ties with Japan-, Korea- and US-based brand companies while constantly expanding our NOR flash and SDRAM product portfolios to satisfy their needs. The relationships became very steady when demand for consumer electronics products boomed in mid-2009. In particular, we were able to expand our flash customer base during Spansion's insolvency proceedings.

NOR flash supply had been tight previously. We were approached by many international consumer electronics vendors for additional capacity, and at that time, price was not their major consideration. We knew this was an unusual opportunity to build connections with these big names. We seized the opportunity, and have continued to cooperate with them.

For Winbond, customers are more like mutual partners. Usually we negotiate how Winbond can support their future designs, and jointly create customized and differentiated products to fit the clients' requirements. Winbond aims to ensure win-win partnerships, which are sustainable over the long-term.

Q: Winbond in 2011 stepped into making NOR flash for handsets. What opportunity did the company see in the sector?

A: Despite being a relative newcomer, we have managed to substantially grow sales of our new handset memory line. Of our total NOR flash revenues in the second quarter, already 10% were contributed by orders for handsets.

Orders coming from the handset sector are expected to make a significant contribution to sales growth in 2011 and 2012.

With system-in-package (SiP) packaging seeing growing adoption among feature phones, sales of our serial parallel interface (SPI) NOR chips have been on the rise. Fellow SPI NOR chipmaker Macronix International is also one of the beneficiaries of the trend.

The growing demand for SiP has allowed Winbond to grab orders from upstream chip suppliers such as MediaTek and Spreadtrum Communications.

Our SPI NOR chips for handsets are available in densities ranging from 16Mb to 128Mb. We have also rolled out new parallel flash devices and expect production for the segment to expand in the second half of 2011.

Q: The third quarter of 2011 is anticipated to be relatively weak compared to the same quarter in previous years. Will the current macro-economic factors affect the company's sales performance in the third quarter?

A: Indeed, the present slowdown in the global economy has cast demand uncertainty. Oversupply has emerged for all memory segments and product ASPs are facing downward adjustments in the current quarter.

If it is just simply an inventory issue, we do not see it as a problem and are confident it will ease in the third quarter. But the biggest problem the electronics industry is facing in 2011 is a slump in end-market demand. The sluggish demand has led to an unusually weak third quarter, and any supply-side growth could bring further adverse impact.

The DRAM sector, in particular, has been hit severely by the general slowdown in the PC market this year. There was no significant growth in production capacity over the past two years, but suppliers' moves to upgrade their production processes have still caused an oversupply. PC consumption of DRAM has also been shrinking as more popular systems, for example, notebooks previously and now tablet PCs, use less DRAM per device.

Q: How will your company respond to the current demand slowdown?

A: Winbond is moving towards the development of new products and new markets, product diversification and customer base growth. Know-good-die (KGD), automotive and industrial applications are the areas we are looking to target in the future.

We will also constantly upgrade technology for better production efficiency. We are set to start volume producing 58nm flash chips in the fourth quarter. The migration to the newer 58nm process will further reduce costs and also boost monthly capacity for our NOR products to 140,000 wafers later this year.

As for our DRAM product segments, capacity for 65nm-made chips has topped 20,000 wafers in the third quarter. We also expect to start sampling products built using our in-house developed 46nm process in the fourth quarter.

Overall, transition to newer process technologies will allow Winbond to produce more dies-per-wafer with lower costs, which should help mitigate the price erosion.

Q: How would you judge the company's order visibility for the fourth quarter?

A: If we manage to continue securing orders from major clients, business outlook for the fourth quarter will certainly not be pessimistic. Another focus is whether the company is able to strike contracts with new customers or for new market segments. If the answer is "Yes," there will only be expansion of our business.

Currently Winbond has three major product lines – SDRAM, NOR flash and mobile RAM. Sales of our SDRAM products have been stable, while the NOR flash segment is expected to see growth in the third quarter despite the fact that the market is getting more and more competitive.

We are more worried about our mobile RAM business, however. Sales generated from the product segment have suffered declines since the second quarter due to excess stockpiles in China and falling ASPs. In addition, the packaging technology transition from MCP to SiP used in handsets has influenced demand for pseudo SRAM due to a combination of factors including compatibility issues and readiness for new processes.

Winbond is migrating to a 65nm process for pseudo SRAM production, with 40% of our total capacity for the memory built using the newer node.

Q: Can you talk about the company's in-house technology development?

A: Unlike other fellow Taiwan-based DRAM makers, which depend on technological transfers from foreign players, Winbond has been developing our own technology since we took over part of the R&D assets from Qimonda in the third quarter of 2009. Two years later,we have achieved a satisfactory manufacturing yield on our in-house developed 46nm process and are now sampling SDRAM products built using the node to customers for design-in, with volume production slated to begin in the fourth quarter this year.

We are pretty clear about the direction we are heading. We will neither return to the PC DRAM market nor license our technology.

Q: Has Winbond tapped the tablet PC market? What is your outlook for the market?

A: Currently we have broken into the supply chain for the popular devices with our NOR flash memory. We also expect to supply our SDRAM chips to tablet PC manufactures in the future.

Winbond's solutions for tablet PCs target the mid-range and entry-level segments and so far we have no plans to produce higher-density 2Gb and 4Gb chips for the devices.

The demand outlook for tablet PCs is optimistic, but I'd rather be cautious. Despite that the market for conventional PCs has little room to expand, the market scale is still as large as 300 million units worldwide. Meanwhile, the potential for other markets, particularly the smartphone sector, still cannot be ignored.

Q: Speculation circulated previously that Winbond is planning to head towards a "fab-lite" strategy. Is this true?

A: Winbond has successfully transformed itself from a PC DRAM manufacturer to a comprehensive supplier of niche-market DRAM and NOR flash chips, which we recognize is a business approach to sustainability. And next, we do plan to go fab-lite.

Initially, we will outsource if in-house capacity fails to meet demand. We currently have a monthly capacity of 36,000 12-inch wafers – 20,000 units for SDRAM, 14,000 for flash and the remainder for mobile RAM.

Q: What challenges are you facing?

A: There are many challenges ahead for us, including the appreciation of the NT dollar and the ongoing supply-demand imbalance. The former will continue eroding our profits while the latter leads to price pressure.

But we aim to turn the challenges into new opportunities, through new product development and technology upgrades. The former will diversify our business to minimize risk exposure while the latter helps us reduce production costs.

To keep up with rising demand for SiP packaging used in handsets, Winbond has launched a complete SPI NOR flash line and the development has started bearing fruit. We have also moved to enhance our NOR flash portfolio, tapping the automotive-use territory dominated by international vendors.

Winbond has cut into the supply chain of more than 10 car vendors and related parts and component suppliers with our NOR and SDRAM memories.

In addition, we are migrating to 46nm technology for SDRAM products and 58nm for NOR chips to further lower production costs.

|