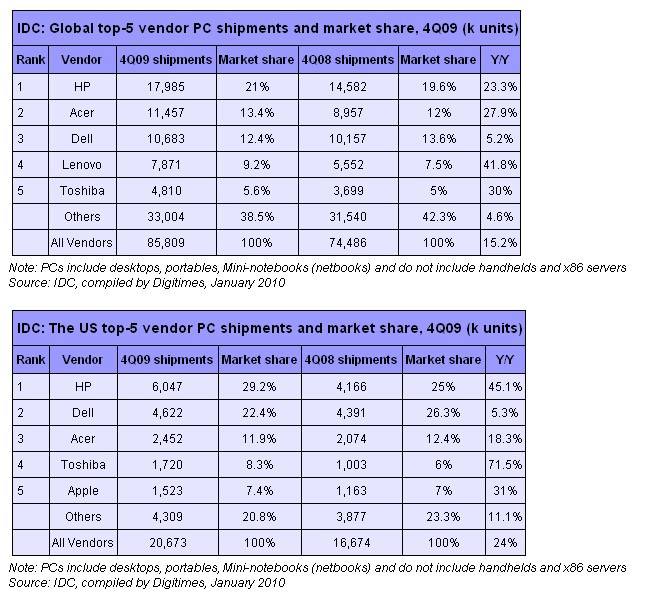

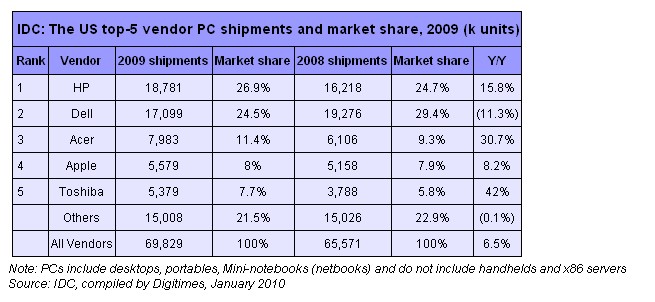

Led by a holiday season featuring price cuts of unprecedented duration, the US PC market established a new record of nearly 20.7 million units shipped in the fourth quarter of 2009, resulting an on-year growth of 24%. Other regions also experienced solid growth, particularly emerging markets in Asia/Pacific and Latin America, leading the global market to 15.2% on-year growth for the quarter, according to IDC.

This marked the first quarter of double-digit volume growth since the third quarter of 2008. The fourth quarter results cap a strong second half of 2009, further cementing signs of a market revival and ending the year with on-year growth of 2.3%.

In addition to the continuation of price declines throughout the year, other factors were in play for the fourth quarter. Following a stream of improving economic indicators, which began in the third quarter of 2009, a release of pent-up demand was evident as buyers focused on a vast array of value-oriented notebooks that dominated the channel landscape in the holiday season.

"The US market exploded in the fourth quarter, driven by a series of factors contributing to the unexpected 24% on-year growth. First is the rubber-band effect and recovery from the year-ago quarter, which suffered from buyer contraction when the economic crisis was confirmed. The vendors responded with new low price points to stimulate demand and face competition. In this context, low-cost notebooks and mini-notebooks (netbooks) were the biggest contributors to the successful fourth quarter. Once again, the consumer market overcame the weak commercial sector to save the quarter," said David Daoud, research manager in IDC the US.

"The market has weathered a storm which looks to be behind us," said Jay Chou, research analyst in IDC. "But salvaging decreasing margins will soon become even more pertinent as one considers the long-term effects of holding market share at the cost of profitability. Without an effective strategy to convey a clear usage model and feature set tied to each segment, the market will inevitably continue down the slippery slope of 'good-enough' computing sold to the lowest bidder."

Regional outlook

The US: Vendor focus has been on the consumer market, targeting buyers with feature-rich SKUs at commodity-level prices. In addition to the low-price points, consumer spending was stimulated by better sentiment than in the year-ago quarter, despite lingering uncertainly over the economy. The launch of Windows 7 provided additional help, albeit moderate, with the solid marketing campaign initiated by the industry to lure customers back into the stores. However, like most regions, business spending will take more time to take hold, as commercial entities wait for tangible signs of sustained economic growth before launching a new refresh cycle.

Europe, Middle East, Africa (EMEA): After three quarters of yearly declines, the EMEA PC market returned to positive territory based on strong holiday sales of mini-notebooks (netbooks) and other lower-cost portables.

Japan: Slightly above forecast, the market grew 4.3% with lower-priced portables being the main driver for consumer-oriented vendors like Acer. Major Japanese vendors also saw above-market growth thanks in part to wins in the education sector, although overall business spending remained stagnant.

Asia Pacific (excluding Japan): Still led the globe in on-year growth at 31%, as bellwethers like China spearheaded the region's economic recovery as well as overall solid regional consumer interest in PCs.

Vendor outlook

Hewlett-Packard (HP) displayed above-market performance in all regions except EMEA, with particularly strong shipments in the US from holiday retail sales. It also gained double-digit growth in the emerging markets of Asia Pacific and Latin America.

Dell was able to get back into positive territory after four quarters of yearly declines. The vendor managed overall growth of 5% and gains of 24% in Asia Pacific market (excluding Japan).

Acer grew 28% worldwide thanks to its dominance in mini-notebooks (netbooks), which have become more pervasive throughout the channel. Its early entrance into ultra-thin portable PCs also has it clearly positioned to benefit from a market, which will be largely price driven for the foreseeable future.

Lenovo was able to grow well in its main markets of Asia Pacific and EMEA, reaping sizable overall on-year growth of nearly 42%. Its restructuring in Japan also seemed to have paid off as the fourth quarter of 2009 was the second quarter of double-digit yearly growth there.

Toshiba's focus on portable PCs paid dividends as it saw overall growth of 30% with solid growth in all regions except EMEA.

|