Traditional year-end demand did not come in the DRAM spot market in 2011 with the overall mainstream products experiencing a downhill trend this week (December 2-9).

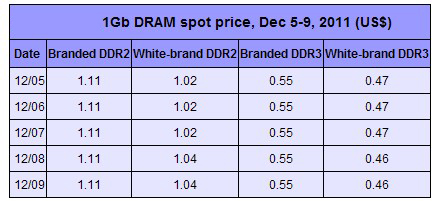

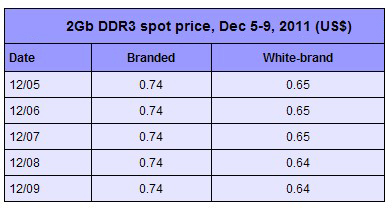

While PC demand remains weak, the DRAM pricing in the spot market might see further decreases through the year-end, the research firm noted citing local traders as saying. As of the noon session of December 9, the spot price of white-branded 2Gb DDR2 dropped 2% to US$0.65 and a branded 2Gb DDR3 was flat at US$0.74.

Contract prices in the first half of December are expected to see a decline though drops have been smaller than last month lifted by potential labor shortages in China. This has been a common situation in China where labor will fall short prior to the Lunar New Year Holidays and vendors, therefore, are securing more inventories one month before the holidays, the research firm explained.

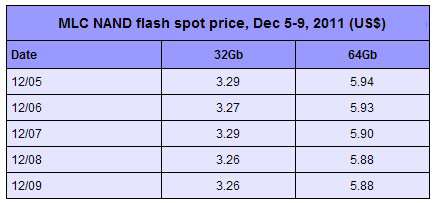

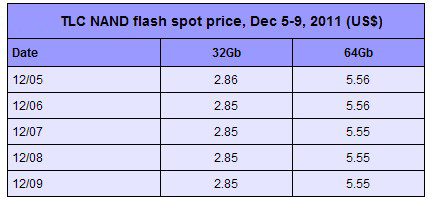

NAND Flash suppliers were adjusting down their pricing this week in the spot market to simulate the slow demand though the results were not satisfying. As of the noon session of December 9, the spot price of 32Gb MLC and 64MLC both fell slightly to US$3.26 and US$5.88, respectively, said the research firm.

In the contract market, overall demand for SSDs is rising on the ongoing shortage of HDDs in the market, according to local module house players and suppliers. The shortage has been reaching 30% in the HDD market due to the floods in Thailand which began in July and continued into this month.

|