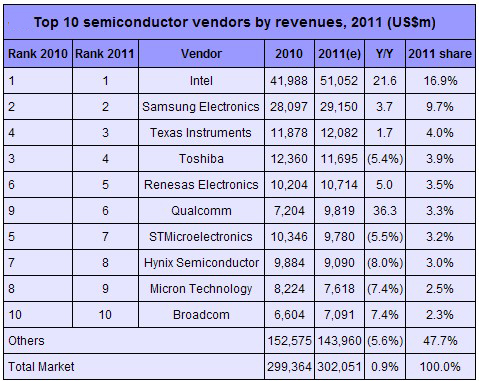

Processor suppliers Intel, Qualcomm, AMD and Nvidia outperformed the rest of the semiconductor industry in 2011, Gartner wrote in its recent report. Worldwide semiconductor revenues grew 0.9% to US$302 billion in 2011, according to preliminary results by the market research firm.

Intel's server business grew despite slowdowns in PC production, while Qualcomm was carried by ongoing shifts to 4G and LTE mobile services. Meanwhile, Nvidia's Tegra platform supported tablet makers hoping to capture some of the enthusiasm associated with tablet PCs.

On the contrary, memory makers among the top 25 semiconductor suppliers - Hynix Semiconductor, Micron Technology and Elpida Memory - showed revenue declines as a consequence of DRAM price declines and loss of market share in the DRAM space.

Intel saw strong growth in the first half of 2011 as the PC market stocked up inventory in anticipation of a strong second half of the year. Its revenues for 2011 also include the wireless business unit purchased from Infineon in the first quarter of the year, a transaction worth about US$1.4 billion to company revenues.

The year 2011 marks Intel's highest-ever market share at 16.9%, according to Gartner. The firm's previous high was in 1998 when it commanded 16.3% of the market.

Second-ranked Samsung Electronics saw its revenues grow slightly above the industry average despite its exposure to the declining DRAM market, Gartner said. Samsung's non-memory business was by far the strongest growth area for the company, with application-specific devices (ASICs), particularly wireless applications processors. The strongest growth came from Samsung's relationship with Apple, where it is supplying the A5 processor used in the iPhone 4s and iPad2 media tablet.

"The industry did well in the early part of the year, in many cases entering the year with backlog from an exuberant 2010," said Stephan Ohr, semiconductor research director. "But uncertainty about the state of the macroeconomy set in at the midpoint of the year. Consumers held off purchases, and infrastructure expansion plans languished as governments resisted assuming more debt. Equipment inventories began to build as the year progressed, with resulting ripples throughout the semiconductor industry."

|