NAND Flash market trend and market situation

【NAND Flash market lead to a high level in March】

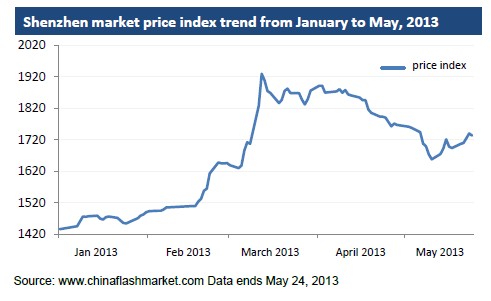

Since the demand of smart phones, tablet PCs and other products continues to heat up, as well as by the influence of original NAND Flash supply shortage, the market price in February and March is very positive. According to the China Flash Market data in January to May, NAND Flash market composite price index from 1436 rose to 1929 since early this year and the highest point is 1929 in March. NAND Flash related products prices also reach to the highest price in March. In April the price index began to decline but in May the overall trend has an obvious sign of rebound.

【Price increase of NAND Flash products restrain the demand in the market】

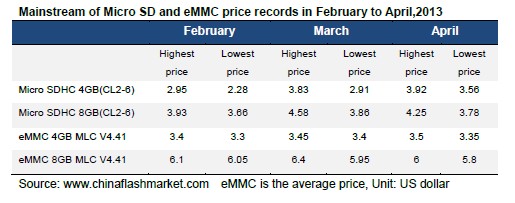

In February and March of 2013, due to the news of huge amount of tight supply in the market, partial businessman is worried about lack of follow-up stock, and some have started store some stocks. So the price rushed to the highest point on NAND Flash related products. According to the China Flash Market quotations, Micro SDHC 4GB (CL2-6) prices in Hong Kong market rose in the early April, the highest price is 3.92 US dollars, 8GB in mid-March rose to the highest price of 4.58 US dollars, after two months of price increasing, compared with the price in early February, 4GB and 8GB price increased by 1.6 US dollars and 0.9 dollars. eMMC 4GB and 8GB prices relatively stable, amount of increase is in 5%.

Many manufacturers made a profit out of the price increasing of NAND Flash related product. However, for the purchaser of mobile phones, tablets, it is equivalent the increasing of production costs, resulting in falling of the profits or losing money. So many purchasers do not want to get many high-priced product orders in April, and some are dumping the stock they prepared in Feb and March, some are just waiting for the market trend. Mobile phone, tablet supplier orders scaled back, the market demand will decline and affect the NAND Flash market overall market trend downward.

【Orders come back in May and demand goes up】

However, after a month of inventory consumption, a lot of mobile phones, tablet and other vendors increase purchases in May. Moreover, in April, the price of most NAND Flash related products have been significantly goes downtrend, some products continued downward in May. Decreasing of consumer storage products inventory consumption in the market, some customers began to accept expensive NAND Flash products slowly, the market of the transaction became more actively. Orders coming back in the market lead prices of NAND Flash related products rebounded in May.

The Strategy of original supplier will impact NAND Flash market

【Original supplier is seeking maximize profits by responding to Market trends】

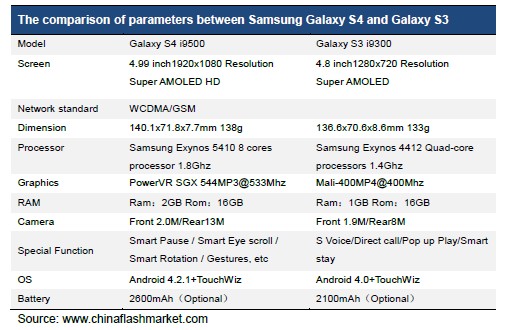

In 2013, the mobile processor of Smart phone has been upgraded into quad-core generation, pushing the capacity of most Mobile DRAM have to be upgraded from 1GB to 2GB, take Samsung Typical products Galaxy Series for example: Samsung Galaxy S3 is equipped with 1GB Low power consumption DDR2 DRAM, Galaxy S4 equipped with 2GB Low Power consumption DDR2 DRAM, the capacity of Mobile DRAM is doubled than the previous generation.

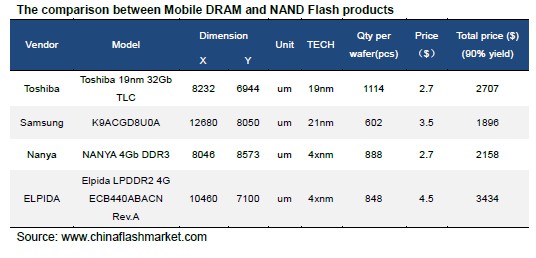

In product selling price, the profit of Mobile DRAM is higher than NAND Flash, take single 12inch wafer for example, Samsung ACG(64Gb TLC) can be cut into 602 NAND Flash Die, the selling price for single good die is around $3.5, according to 90% of the yield point of view, wafer total selling price is around $1896, but Elpida LPDDR2 4G can be cut into 848 die, single selling price can be at $4.5, total selling price can be around $3400, about $1500 higher than ACG products.

The Major Supplier for Mobile DRAM in Global are Samsung, SK Hynix, Elpida, the demand of Mobile DRAM market is increasing, and the profit Mobile DRAM is higher than NAND Flash, the product equipment for NAND Flash and DRAM is not quite different, so Samsung, SK Hynix tend to change the NAND Flash production line into Mobile DRAM production, more investment will focus on high margin products.

In addition, Samsung's use their own Mobile DRAM in Galaxy S4. In order to meet the Mobile DRAM market demand and increase profit, parts of Samsung NAND Flash production line will be used for producing Mobile DRAM in May, and from June, the output amount of NAND Flash will be reduced, Meanwhile SK Hynix also increased the production percentage for Mobile DRAM, and reducing the output amount of NAND Flash.

【The output volume of NAND Flash Nanometer process conversion is restricted】

In 2013, the main NAND Flash chip vender such as Samsung, Toshiba, Micron, SK Hynix has been fully produced 2ynm process technology, according to Chinese flash market research data, it shows that in 2013 Q2 , each chip vender has increased the production proportion of 2ynm process technology up to 85%, in Q3, they will increase the production proportion for 1xnm technology, it can be expected that there will 70% of production capacity of Samsung will be changed to 19nm from 21nm, 16nm will be mass produced at the end of 2013 or in early of 2014, Toshiba will be focus on 24nm and 19nm, and the percentage of 19nm will keep on increasing, at the end of 2013 will change in to 16nm, in Q1 2014, it will be mass produced; Micron and SK Hynix will turn into 18nm from 20nm, in the middle of 2014, 16nm and 15nm will be ready for mass production.

In Q1 and Q2 of this year, it is off-season for market demand, Q3 is peak season, in response to the arrival of the peak season, the original factory prefer to increase the percentage for production proportion and conversion of Process Technology in off-season, in Q3,the production will be stable, on the process increasing production proportion and technology transfer, yield and stability will indirect effects the output volume of NAND Flash, the result is that the overall output volume will be effected.

【NAND Flash Shortage Appears in Market】

Samsung is the biggest supplier of NAND Flash, begin to develop cell phone and tablet products since 2013. Volume of Galaxy S4 reaches 10 million pcs less than a month, this means their own cell phone and tablet has used up a lot Samsung NAND Flash, and at the same time they need to buy a lot flash from Toshiba and SK Hynix. From this we can see shortage is there in market. In fact, Samsung supply NAND flash only to some key customers in order to maintain market price stability, among these flash, most of them has capacity over 32Gb and 64Gb TLC, not much MLC, which mainly apply on their own embedded products and SSD.

It is understood, Toshiba and Sandisk also don’t have redundant MLC wafer in big quantity, not much 32Gb and 64Gb TLC wafer goes into channel market. For HynixNAND Flash, which produced in M11 and M12, part of them sold to Samsung, and the others are kept using in their own embedded products and Apple product. Only a little 64Gb MLC TSOP flash goes into tablet market, and 16Gb MLC wafer is supplied to sustain several module clients.

In conclusion, Samsung, Toshiba and SK Hynix do not have much stock to market. Most appeared in market is Micron flash. May is the deadline of financial results of Q3, they will clear some part of their stock, so at that time, a lot Micron and Spectek flash will go into market. That’s why most of factories and channels didn’t buy Micron flash at the beginning of Apr. and May. because of high price at that time. Actually, Micron planed strategy to get more profit, they sold L83 in the form of TSOP, but not wafer. L72 wasn’t sent to market because it’s going to be stopped. L74 was assigned to their SSD department and L84 to their embedded product, like eMMC and eMCP, which both will go large scale production soon.

Now it’s the end of May, more and more info shows Micron will not supply flash to market. Shortage warning becomes serious which make channel dealers and factories very disappointed. Predict in June, market will show its recovery and more deals will be made. The market demand rebound, volume of Samsung & SK Hynix NAND flash reducing a lot, shortage will come unavoidable even in slack season.

Demand of NAND Flash growing even in slack season, market becomes healthy

Hot product of smart phone and tablet in 2013 lead huge demand of eMMC/eMCP, memory card with high capacity, mobile DRAM and processor. And benefit from mobile network, SSD grows steady in cache server. Actually supplier of these high-profit products is relative centralization, that’s why factory production line gradually gets balanced, not like a single product before. We can say NAND Flash overall development trend is better.

Compare with traditional storage card and USD drive, micro SD with high capacity grows because of high smart phone configuration. But low capacity micro SD goes worse. The demand of USB 2.0 declines but USB 3.0 demand increases. Original supplier focus on high capacity wafer and not supply a lot low capacity ones. Supply shortage can maintain the stability of the market, and this kind of supply shortage shows not only on products with low capacity but also on slack season in 2013. This results good market demand appears even in slack season and NAND Flash market becomes healthy.