Most Taiwan-based DRAM module houses including A-Data Technology, Transcend Information and Power Quotient International (PQI) are likely to post revenue drops of 10-20% sequentially in May 2010, as demand for memory cards and USB drives slipped significantly mainly due to weak sales in Europe and the US, according to industry sources.

However, the module makers are expected to see revenues rebound in June buoyed by a pickup in orders from the China Market, the sources said.

The sources also expect NAND flash pricing may drift higher in June, as Apple is about to re-stock its inventory.

According to latest data, contract quotes for 16Gb multi-level cell (MLC) NAND flash chips continued to edge down in the latter half of May, averaging US$3.93 compared to US$3.96 in the early half of the month. Meanwhile, average prices for 32Gb and 8Gb slid to US$7.19 and US$3.85, respectively.

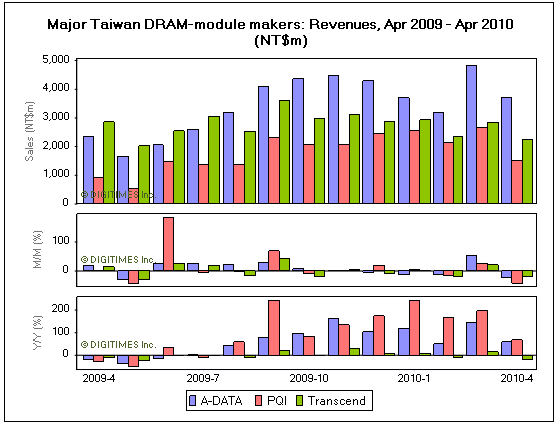

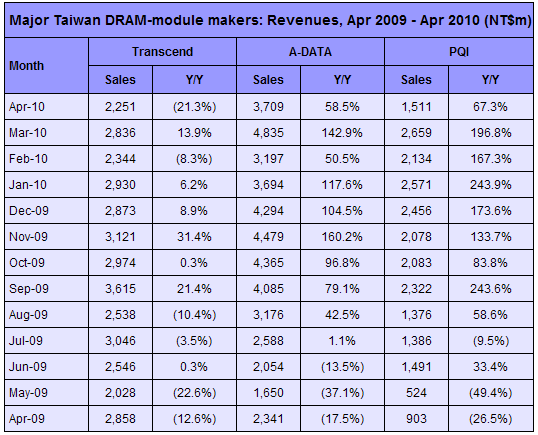

A-Data, Transcend and PQI suffered sequential revenue declines of 23.3%, 20.6% and 43.2%, respectively, in April. Compared to revenues a year ago, both A-Data and PQI enjoyed revenue growth of over 50% in the month, while Transcend saw revenues decrease 21.3%.

In other news, upstream DRAM makers Powerchip Semiconductor Corporation (PSC), Nanya Technology and Inotera Memories have reported mixed results for May.

|