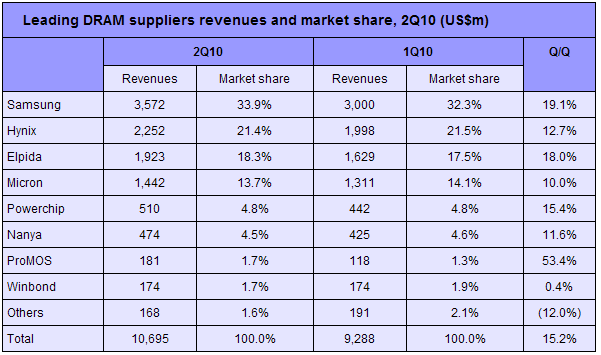

Global DRAM revenues increased 15.2% sequentially to US$10.7 billion in the second quarter of 2010, thanks to stable contract prices and a mild growth in output, according to the latest data.

Contract prices for 2GB DDR3 modules rose 10% sequentially in the second quarter, when spot prices for 1Gb DDR3 chips slid 3% on quarter to average US$2.77. Meanwhile, DDR2 output was significantly lower in the quarter though DDR2 1Gb spot price showed a deeper downtrend, the firm added.

Worldwide DRAM output increased 10% sequentially in the second quarter, but wafer starts grew only 3.8%. Chip suppliers are focusing more on technology migration instead of capacity expansion, the firm indicated.

Samsung Electronics continued to lead the market with a 33.9% share in the second quarter. Hynix Semiconductor followed with a 21.4% share in the quarter, while Elpida Memory strengthened its third-place spot.

Samsung's output in the second half of 2010 will continue its growth momentum, as 46nm and 56nm products have entered mass production levels with stable yields. The vendor's DRAM revenues grew 19.1% on quarter to US$3.57 billion in the second quarter.

Buoyed by capacity support from subsidiary Rexchip Electronics, Elpida Memory saw revenues increase 18% on quarter to US$1.92 billion in the second quarter. Meanwhile, Micron Technology enjoyed revenue growth of 10% sequentially in the second quarter thanks to a 9% ASP rise.

ProMOS Technologies' revenues soared 53.4% to US$181 million in the second quarter, allowing it to move up to number-seven. Powerchip Technology and Nanya Technology retained their fifth and sixth spots, respectively, in the second quarter.

|