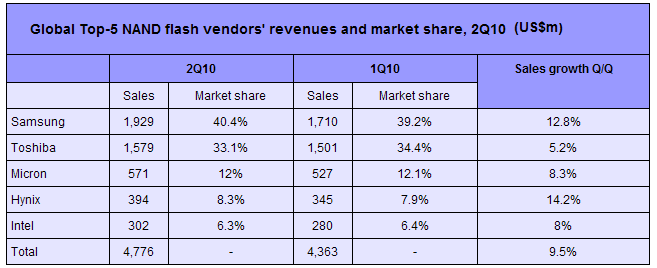

Increased supply 3-bit-per-cell parts pushed bit growth of NAND flash production in the second quarter of 2010, but dragged prices down, according to the latest data. As a result, the NAND market generated revenues of US$4.78 billion in the second quarter, up only 9.5% from US$4.36 billion in the first.

Despite its cost advantage, 3-bit-per-cell multilevel cell (MLC) flash technology performs less stably and consistently than today's 2-bit per cell ones. The 3-bit-per-cell flash parts still cannot be used as built-in memory for smartphones, tablets or SSDs, though the chips have gained growing acceptance in memory cards and USB drives.

But demand from the memory card and USB drive segments has been sluggish since the second quarter, due to the impact of the debt crisis in Europe as well as the traditional slow season during the quarter. As a result, an oversupply of 3-bit-per-cell parts drove down the overall NAND ASP in the second quarter.

Samsung Electronics and Toshiba continued to rank as the top-two NAND flash chip vendors in the second quarter, with their combined share reaching 73.5%.

Samsung's NAND bit shipments grew by about 25% on quarter in the second quarter, as stable orders placed by its contract customers helped reduce the impact of weak sales of memory cards and USB drives. However, Samsung's overall NAND ASP fell by 10% sequentially in the quarter, affected by its growing output of low-cost 3-bit-per-cell parts.

Meanwhile, Toshiba saw its NAND flash sales increase by only 5.2% on quarter in the second quarter. Sales were also impacted by a slight decrease in ASPs.

In other news, late July contract prices for 32Gb 2-bit-per-cell chips edged down 0-3% to average US$6.44, while those for same-density 3-bit-per-cell ones slid 3-5% to US$5.38.

|