Spot price of low-density NAND flash has gained strong momentum recently, thanks to demand from makers in China trying to product iPad-like devices.

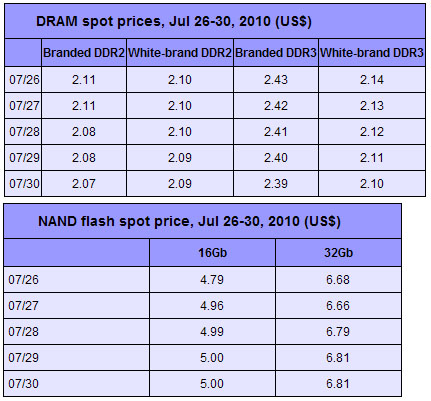

As of the noon session of July 30, spot pricing of 16Gb and 32Gb multi-level cell (MLC) NAND flash chips grew 4% and 2% to US$5 and US$6.81, respectively.

Observed a stronger demand uptick for both 16Gb and 32Gb NAND flash for the week July 26-30. Many China-based brokers/traders sourced low-density flash for use in white-box tablet PCs, which usually carry a memory density of 16GB.

Since controllers in these devices only support older error-correction code (ECC) configurations, only those chips which are fabricated on 5x nm are compatible. Yet, as most vendors have migrated their mainstream process to 4x/3x nm, the limited supply at channels thus led to a sudden supply strain.

In the DRAM spot market, a mild price drop continued into the week. Demand for both DDR2 and DDR3 remained slow at channels. Overall sentiment got worse when leading module makers further revised down their quotes.

As of the noon session of July 30, spot pricing of 1Gb DDR2 and DDR3 averaged at US$2.08 and US$2.25, respectively, each representing a 2% drop.

|