ALi and Sunplus Technology, two Taiwan-based IC design houses specializing in multimedia and PC peripheral chips, have both outlined a conservative outlook for the third quarter of 2010.

ALi expects revenues for the third quarter to decline by up to 10% on quarter, as demand from Europe is picking up slowly, according to company president Ben Lin. Gross margin for the quarter may slide to between 40% and 43% as sales of its lower-margin chips for multimedia applications grow.

Lin was quoted in previous reports saying ALi's set-top box (STB) solutions would be the company's major growth driver for 2010, with products mainly shipping to Europe.

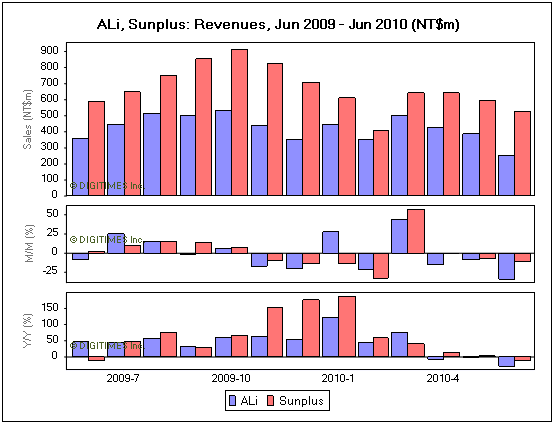

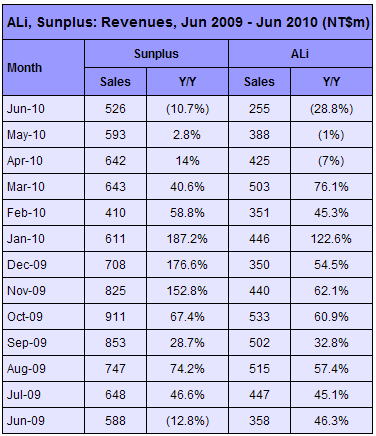

ALi posted consolidated revenues of NT$1.07 billion (US$) in the second quarter, down 17.8% on quarter. The company attributed the sales decline to Europe's credit crisis as well as low seasonal demand. Gross margin was 43.3% for the quarter.

Sunplus also supplies STB chips mainly to Europe. The chip designer said revenues may not return to an on-month growth track until September.

Sunplus registered revenues of NT$1.76 billion in the second quarter, up 5.8% sequentially. The result missed market watcher estimates of double-digit growth.

Sunplus expects third-quarter revenues to remain flat or grow by single-digits compared to levels in the second quarter, according to the company.

|