A price correction occurred in the NAND Flash spot market this week (August 2-6) amid widespread concerns about pricing pressure from the upcoming launch of products made by new processes.

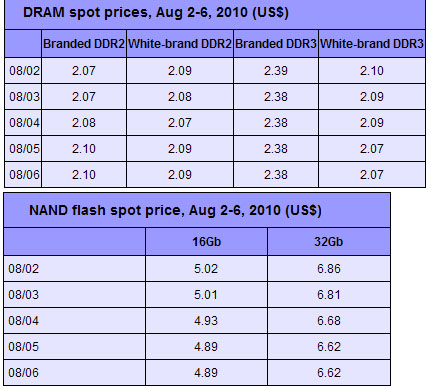

As of noon August 6, spot prices of 16Gb and 32Gb multi-level cell (MLC) NAND flash chips both dropped by 3% to US$4.89 and US$6.62, respectively.

The low-density flash segment should not post sharp price erosion in the near term as demand from China is still strong. The mild price correction this week stemmed mainly from buyers' reluctance to buy, as they thought prices were already too high. The price of 16Gb MLC flash has grown by almost 25% since June.

For the high-density segment, demand was deterred by anticipation of the negative impact from the upcoming launch of products made by new processes, the research firm said. Leading players including IM Flash and Toshiba are set to volume produce with new processes in late third quarter.

In contrast to NAND flash, DRAM spot prices were relatively stable this week. According to the latest data, DDR2 price rebounded mildly, thanks to raised quotes by some leading memory module houses. But DDR3 demand remained low.

As of noon August 2, spot prices of 1Gb DDR2 and DDR3 averaged at US$2.09 and US$2.23, respectively.

|