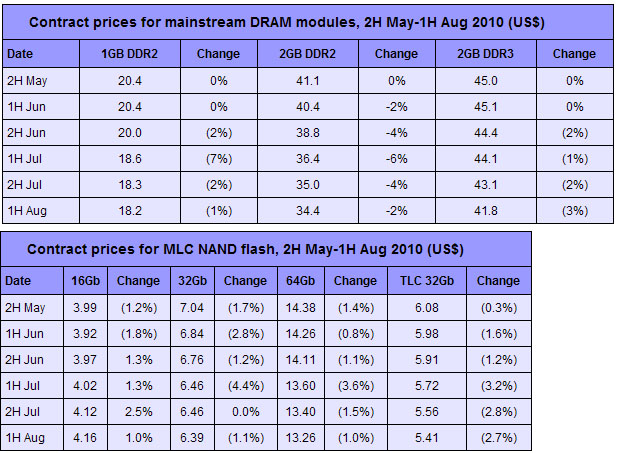

The DRAM and NAND flash contract markets have seen price corrections continue for the first half of August as a result of slow demand.

The contract price for 2GB DDR2 modules has dropped by 2% sequentially to US$34.40 and DDR3 modules have seen a 3% decline to US$41.80.

The downhill price trend for DDR2 is no surprise as most PC vendors do not require as many as before. As the market is now more demand driven, vendors have little choice but continue cutting prices to digest inventory.

Despite an unexpected price rebound in the spot market earlier this week (August 9-13), the firm said it was spurred by speculative trading and when more vendors/traders clear their inventories, prices will head south soon.

Having seen most PC OEMs post much weaker-than-expected sales in July, most vendors/OEMs have become more conservative about their outlook. The conservative sentiment has cast a shadow over the DDR3 contract market.

The NAND flash contract market has encountered a similar situation. The contract price for the mainstream 32Gb multi-level cell (MLC) flash has posted a mild 1% sequential drop to US$6.39 and the three-level cell (TLC) has seen a 2.7% decline to US$5.41 for the first half of August.

The contract price has yet to see a big price drop as some vendors still have most of their high-density chips reserved for OEM customers. But channel demand is still very slow with sharper price erosions taking place in the high-density segment this week. Any negative guidance revisions at handset makers will weigh on contract prices.

|