After two years of inflated prices, NAND flash memory at the end of 2010 is set to return to the key US$1 per gigabyte (GB) level considered a key threshold to drive adoption of solid state drives (SSD). However, the cost reduction may come too late to help the struggling SSD market, said the market research firm.

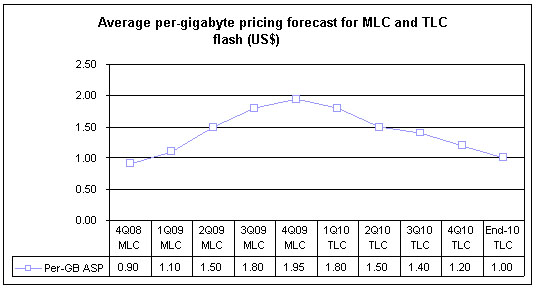

Pricing for 1GB of 3-bit per cell (TLC) NAND flash memory will average US$1.20 for the entire fourth quarter, and then decline to US$1.00 at the end of 2010. This represents a precipitous drop from the first quarter of 2010, when pricing for TLC averaged US$1.80 per GB and 2-bit per cell (MLC) flash was at US$2.05. It also marks the first time NAND flash pricing fell below the US$1 threshold since the fourth quarter of 2008, when MLC pricing averaged US$0.90 per GB.

"When NAND pricing first fell below the US$1 level at the end of 2008, many observers opined that its would sound the starting gun for solid state storage, allowing the technology to be cost competitive with hard disk drives (HDDs) in PCs for the first time," said senior analyst. "However, during the following quarters, pricing rose because of strong demand and constrained production capacity, limiting the appeal of SSDs to low-volume servers in data centers and preventing widespread adoption in high-volume business and consumer PCs."

Now with pricing back to the US$1 level, the SSD market is ready to get back on track, or is it?

"With NAND pricing having returned to per-GB pricing levels not seen in two years, there's likely to be a lot of new buzz created for the solid state storage market at the end of 2010," analyst said. "However, traditional HDDs gained a lot of additional ground during the past few years in terms of rising capacity and falling prices. In fact, HDDs have gained so much ground that SSDs now are in danger of never regaining their competitive footing."

To compete successfully with HDDs, per-GB pricing for NAND flash memory will have to decline to US$0.40 by 2012, analyst said. At such pricing, a 100GB SSD could cost US$50, when supporting electronics are added in. This would make solid state storage more appealing in consumer and corporate PCs.

A little TLC goes a long away

The second half of the year is almost certain to see shortages for MLC NAND. However, the complete opposite is the case with TLC as supply is sufficiently ahead of demand. Average capacity for TLC chips in SD (secure digital memory) cards and USB storage devices has stagnated during the past year. When combined with a slowing unit demand due to seasonality, ASPs for TLC chips are falling.

Reaching consumers

Low TLC prices are reaching consumers, which will aid in the purchase of higher-density products. the market research firm predicts the third quarter will see an uptick in growth for TLC NAND flash memory; driven by numerous holidays and back-to-school promotions.

To this end, tightly managed inventory levels, along with the closing of some factories, are paving the way for new price competition in the TLC segment, indicating a very real possibility that the magical US$1 per GB level might be reached by the end of 2010.

That being said, the market research firm believes these lowered component prices, paired with seasonal demand growth in 2010, will lead the overall industry for NAND flash memory to reach a record US$5 billion in revenues in the third quarter.

|