DRAM contract pricing continued a downtrend in the later half of August, reflecting weak PC sales and a conservative outlook among PC OEMs.

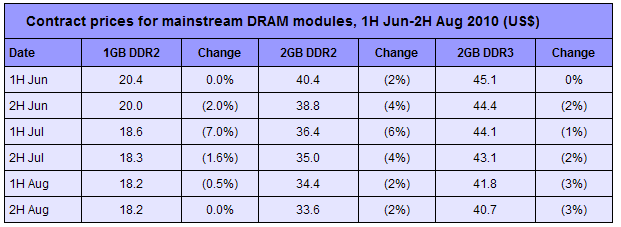

Contract pricing for 2GB DDR3 modules dropped 1% to US$40.70 and DDR2 modules 3% to US$33.96 in the second half of August, translating to US$2.42 and US$1.98 per Gb.

Major vendors were able to prevent a sharp price fall because OEMs did not place big orders in the later half of August. OEMs are still very cautious about building up inventory amid weaker-than-expected sales in July.

Despite that most OEMs expect a sales rebound in August and September, most have expressed concern about the magnitude. The research firm estimated that PC sales are likely to post zero growth on a quarterly basis in the third quarter.

Most OEMs will continue to be conservative about procurement through September as their average inventory level is sufficient to fulfill demand. They will only grow procurements if DRAM contract prices post a sharper drop.

On the vendor side, expects leading players to launch more aggressive pricing for high-density memory modules in order to stimulate system content growth, especially for those who have a faster migration to 4xnm 2Gb DDR3 production.

|