NAND flash contract pricing will see its downhill price trend to continue into the fourth quarter, with a sharper sequential drop already seen in the later half of September.

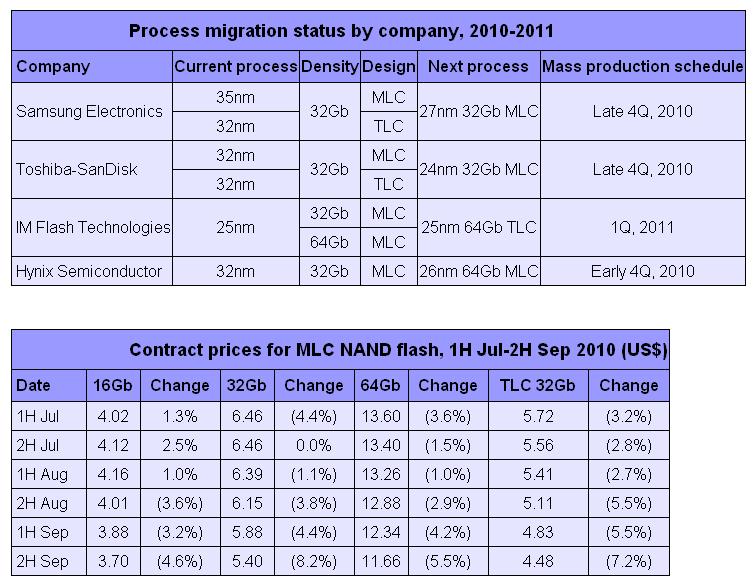

In the second half of September, contract price for mainstream 32Gb multi-level cell (MLC) NAND flash chips dropped 8% to US$5.40 and the same-density triple-level cell (TLC) chip has dropped by 7% to US$4.48, both saw their sequential drops enlarged.

Sluggish demand for all kinds of NAND-based applications is expected to continue into the fourth quarter. Citing some leading memory module houses, sales for USB flash drives and memory cards have shown no improvements from July with some experiencing flat sales over the last three months. In light of high inventory levels, most memory module houses are reluctant to take on more stock despite price cuts, said inSpectrum.

On the vendor side, vendors who have not yet had their new chips validated by key OEMs are expected to continue releasing more supplies at competitive prices as they have nowhere to sell the chips. Most vendors have their new 30nm- and 20nm-class process focused on high-density chips, with the new chip designs limiting their application to high-density ones such as solid-state disk (SSD) and embedded multi-media card (eMMC). Yet, when demand is weak across the board, more chips thus weighs further on the weak pricing.

ASPs for mainstream 32Gb MLC flash will decline by 9% in the fourth quarter, versus the 3% drop as estimated before.

|